Top 5 Mistakes Businesses Make in Cash Flow Management

For any business, finance plays an important role that you can not ignore. Hence finance management mistakes can turn out to be a massive blow to the growth of a company.

For business owners, financial management acts like a rescue by encompassing the organization, control, and decision-making processes related to a company’s finances.

Note: Learn how to hire a financial planner for your business

Thus, finance management has become the top priority for gaining financial goals and managing business aspects such as :

- Profit planning

- Working capital management

- Investment and acquisition of funds

- Dividend decision, and more.

Top 5 Mistakes Businesses Make in Cash Flow Management

However, there are a few financial management errors that can put your business in trouble. So make sure to avoid these finance management mistakes.

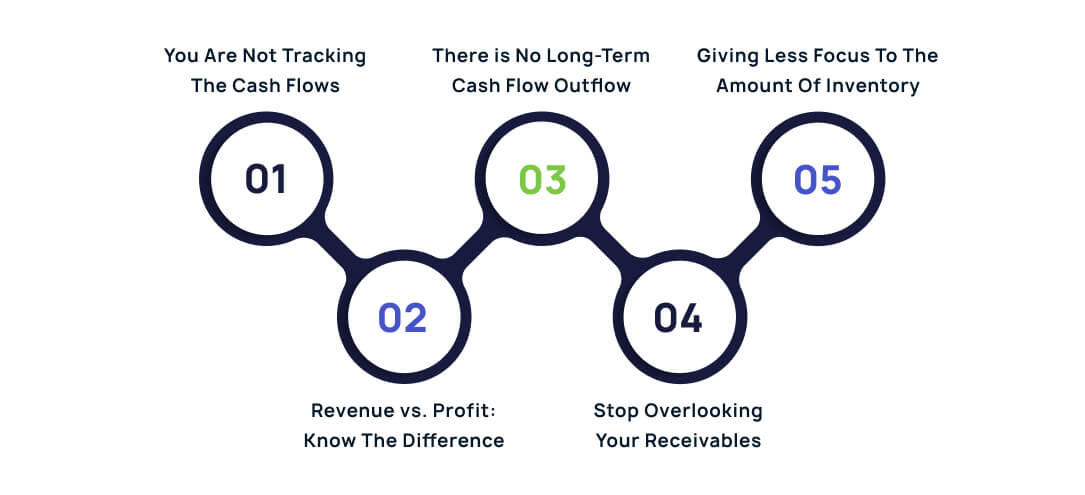

You are not tracking the cash flows.

Many business owners think that overseeing a company’s bank account, monitoring tax liability, and checking the income statement every month are all part of financial management. Although they have heard of cash flow management, many are unsure of the precise steps involved. You’re not the only one doing this! Entrepreneurs who are truly successful focus a lot of emphasis on tracking their cash flows. They have a cash flow overview, which helps them understand their financial situation. They will be able to make wise managerial choices as a result.

Revenue vs. Profit: Know the Difference!

Profit is given a lot of thought in a company, yet without the capacity to cover employee wages and supplier obligations; businesses fail long before the year’s income statement shows the ultimate economic outcome. The income statement contains important information for the analysis of business efficiency. Regretfully, it doesn’t reveal much about your actual income.

However, the majority of business owners make this error and concentrate on making money. Are you also one of them? Perhaps you have already considered it. In actuality, the economic category of cash flow and the accounting concept of economic results are not the same. The difference between expenses and income is expressed as profit or loss. The gap between cash revenue and expenses is known as cash flow. Just as revenues frequently do not equate to the immediate collection of funds, expenses do not always reflect all costs.

There is no long-term cash flow outflow.

An excellent place to start is with a solid understanding of past and present incomes and expenses. However, you are essentially staring at a wall if you only look at the maturity horizon of issued and received invoices. However, in order to effectively run the business, one must look beyond the present month. It would help if you foresaw impending financial constraints before they occur in order to manage your company’s finances properly. It is well worth the time and effort to plan and manage cash flow.

Stop Overlooking Your Receivables

Sales increase when a business is doing well. Why worry about cash flow if sales increase? Ignoring the connection between sales and income is another frequent error made in a company’s financial management. Operating financing is under pressure due to rising turnover. With larger sales volumes, the company’s receivables are worth more. On the other hand, a problem can occur if the maturities of obligations and receivables differ.

Smaller business owners who supply businesses in particular need to take proactive measures to collect their debts. Smaller businesses frequently don’t charge late fees to their clients. Similar to this, procedures for making on-time payments are either put up thoroughly or very sparingly. You can be confident that you will be one of the last suppliers your business partner tries to pay if they are unsure that they will find out about you right away once they are late with the payment.

Giving less focus to the amount of inventory

Operating cash flow may be impacted by a decline in sales since it may also result in a more significant requirement for funding. In most situations, you won’t be able to immediately adjust the amount of inventory to a lower level of sales, even though the amount of working capital will fall. It’s critical to have up-to-date knowledge of how variations in sales affect cash flow development so that you may promptly propose solutions, use them to stabilize cash flow, pay your debts, and prevent imminent insolvency.

Businesses that don’t keep an eye on inventory levels on a given day typically don’t give much thought to the turnover ratio of their stock or how extended inventory costs the business money. These businesses lose out on the chance to purchase their inventory at a favorable ratio between the expense of holding it for an extended period and the advantage of doing so at comparatively lower pricing. Regardless of whether you are drawn to a more favorable time of buy or a more affordable purchase with a higher volume, it would help if you also kept an eye on whether the purchase aligns with the company’s current inventory needs.

Conclusion

To have a successful business, effective cash flow management is an absolute necessity. Avoid these common mistakes and save your business from unnecessary financial strain. Stay proactive, aligning financial decisions, staying proactive, and monitoring cash inflows will help you ensure stable and sustainable growth.

Need the right advice to navigate these challenges? Connect with seasoned financial advisors in Expertify Now and optimize your cash flow strategies. Download the app now!

Cash flow management involves tracking, analyzing, and optimizing the movement of money in and out of your business to maintain financial stability.

It ensures your business can cover operational costs, invest in growth opportunities, and avoid financial crises.

You can improve cash flow by tracking inflows and outflows, optimizing receivables, managing inventory effectively, and planning for long-term financial needs.

Download Expertify Now to connect with financial advisors who can help you create effective cash flow strategies.

You may also like…