Top 10 Accounting Software Trends in 2024

Accounting is undergoing a revolution; accountants are now at the pioneer of innovation, strategy, and dynamism, replacing the conventional, lonesome number-crunching days.

One thing is certain: these developments are primarily the result of technology. Thanks to these advancements, accountants may now concentrate on business development and client consulting services instead of menial administrative duties.

Regardless of your level of expertise, staying current with the latest trends in accounting software and being flexible are essential for success. We’ll walk you through the main accounting trends that will probably influence the sector over the coming years in this article.

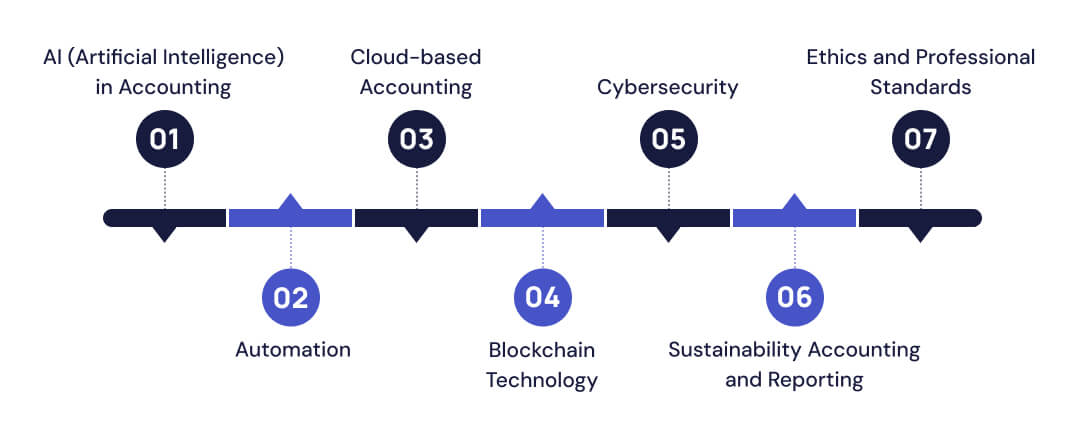

Top 7 Accounting Trends of 2024

There is a lot going on in the industry right now, so this is by no means an entire list. These ten trends, however, were carefully chosen because they

reflect some of the biggest changes that will affect the accounting industry in the years to come.

These patterns show how technology, data-driven insights, and client-focused services are becoming more and more significant in the accounting industry. Adopting them will increase your productivity and enable you to give your customers better value in the years to come.

AI (Artificial Intelligence) In Accounting

AI became widely known after ChatGPT was released in late 2022, which was a watershed moment. This sophisticated language model sparked broad attention and adoption across a variety of industries by demonstrating AI’s ability to comprehend and produce prose that is human-like.

The accounting industry is no different. A Thomas Reuter analysis states that 13% of tax and accounting businesses polled want to employ GenAI technology in the near future, while 8% are currently utilizing it.

However, how precisely are they integrating GenAI into their accounting tasks? Accounting/bookkeeping, tax research, compliance, tax return preparation, and document review are the top five use cases for businesses that already use it or want to use it.

Automation

An increasing number of businesses are beginning to automate their cumbersome manual workflow procedures. 55.2% of accounting businesses purchased workflow automation software to address their workflow problems, according to our state of accounting workflow automation report. The industry’s increasing awareness of automation’s advantages is reflected in this high adoption rate.

- 34.8% of workers now spend an average of 0–1 hours each week scheduling and allocating tasks

- 33.5% now spend 0–1 hours reviewing and updating the status of work each week

- 55.2% say automation undoubtedly made their onboarding process go more smoothly, 32.9% say automation has made their company much more collaborative

- 45.5% say workflow automation has made it faster to receive client documents.

Additionally, according to 27.6% of respondents, workflow automation has the greatest influence on their company’s ability to adopt standardized procedures and systems.

Cloud-based Accounting

The days of needing to install accounting software on each computer are long gone. Cloud-based accounting software is already commonplace, enabling businesses and clients to work together remotely and access financial data. This change has allowed for real-time insights, increased data protection, and increased efficiency.

Blockchain Technology

Since its launch in 2009, blockchain technology—which was first created as the foundation for cryptocurrencies—has been gaining popularity across a range of sectors. Professionals and scholars have been interested in its possible uses in accounting and finance in recent years.

Conducting audits is one use for it. Conventional audits can be laborious and prone to mistakes. However, by producing an unchangeable and visible record of every transaction, blockchain technology has the potential to completely transform the auditing process. This would make it simple for auditors to confirm the correctness of financial records and spot any inconsistencies.

The double-entry bookkeeping system issue is also resolved by blockchain technology. Both businesses are able to enter their transactions straight into a joint register that is cryptographically sealed and cannot be changed or deleted.

Cybersecurity

Because they handle sensitive financial data, accounting firms are often the focus of cyberattacks. The frequency of cyberattacks is high right now. According to an ITRC data breach report, the financial services sector experienced 744 compromises in 2023, making it the second-highest number of data firms. Additionally, there were more data breaches recorded in the US than ever before.

Because of this, cybersecurity is now a major business risk for accounting companies of all sizes rather than just an IT issue. Strong cybersecurity measures must be given top priority by businesses in order to preserve client data and uphold confidence.

Strong access controls, frequent security assessments, employee awareness training, purchasing cutting-edge cybersecurity solutions, and updating them as necessary are a few precautions you can take.

Sustainability Accounting and Reporting

Businesses are finding that sustainability accounting and reporting are crucial as environmental and social issues gain traction. Businesses must track and document their social responsibility programs, environmental effect, and sustainable practices. In order to give stakeholders clear information, sustainability accounting focuses on evaluating and quantifying organizations’ social and environmental performance. Investor demands and legal constraints are likely to encourage a greater focus on sustainability accounting and reporting in 2024.

Ethics and Professional Standards

Professional standards and ethics are essential to the accounting field, and their significance will only increase in 2024. It is expected of accountants to adhere to codes of conduct, preserve professional integrity, and keep the highest ethical standards. Accountants will encounter new ethical issues as the field develops, such as worries about cybersecurity and data privacy. The accounting industry will continue to place a high premium on professional standards and ethical behavior in 2024.

Conclusion

Stay updated on what’s happening and adaptable to change. It will help you get a better understanding on how to navigate the future, meet new clients, and ensure long-term success.

In short, your career in accounting will shine brighter if you are willing to adapt and embrace change. At Expertify Now you can begin your career with a kick start. Download the app now from Google Play or Play Store.

For any queries contact our support team, we are here to help you always!

The trends of 2024 include automation, AI, Blockchain, cybersecurity, sustainability accounting, and professional ethics.

AI provides help with tax research, compliance, bookkeeping, and document review, making tasks faster and more efficient.

Blockchain enhances audit processes by providing an immutable and transparent record of transactions, improving accuracy and security.

Accounting firms handle sensitive financial data, making them prime targets for cyberattacks. Strong cybersecurity protects client data and builds trust.